Friday, May 1 marks one month since Chinese President Xi Jinping announced the restart of the Chinese economy. On April 1, the leader was photographed visiting Zhejiang province without a protective mask, sending the message that China was getting back to normal.

One month on, China’s experience with rebooting its economy holds lessons for the rest of the world. In the midst of a global demand slump, the country that provides nearly one-third of global manufacturing is experiencing the pros and cons of a post-coronavirus restart.

Low commodity prices, high margins

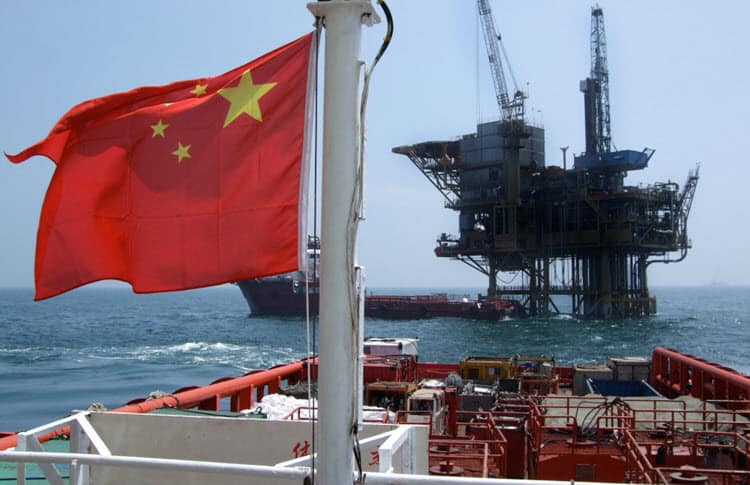

As the first country to restart its economy following a major national outbreak of the COVID-19 virus, China is facing a new playing field. Demand for products is low, but the materials required to produce those products is also at unprecedented lows. Chinese plastic production provides a clear example of the world’s twisted demand and supply situation.

Chinese-produced plastics are primarily used in manufacturing and packaging. The plastics industry uses naphtha, a gasoline-like flammable liquid that can be turned into low-density polyethylene, for transparent plastic bags and packaging, or high-density polyethylene that is used to produce more solid plastics.

Because naphtha is produced from oil, which is at unprecedentedly low prices, the margins for producing naphtha-based products rise. Industry analysts can subtract the price of naphtha from wholesale prices to arrive at production margins. This methodology has revealed that low-density polyethylene margins have gone from $400 to $560 per ton, and high-density polyethylene margins have doubled, from $250 in late 2019 to $500 today.

Working in a post-coronavirus workplace

As business leaders in China are weighing their margins and deciding what to produce, the workplace has changed radically. China is experiencing an increased need for public health facilities while businesses perform in-house COVID-19 monitoring and ensure staff wear necessary protective equipment.

The Chinese workplace today meets most of the guidance that the International Labor Organization is issuing for nations contemplating the restart of their economy in the near future. While the focus is on preventing COVID-19 infections, businesses must prioritize worker safety, according to Sun Huashan, the vice-minister for China’s Ministry of Emergency Management.

On Monday, April 27, the vice-minister delivered a briefing on safety risks during China’s restart. Unused inventory of chemicals and other dangerous goods should be carefully monitored and staff must be provided with sufficient safety training, in order to provide workplace safety and accountability, according to Sun.

Low consumer confidence

Many manufacturers and retailers had hoped for a burst in shopping following the lifting of tight restrictions. So-called “revenge shopping” after months of restricted access has not materialized; instead, Chinese consumers are focused more on saving than spending. This, however, could be a specifically cultural factor in China, as its consumers were already increasingly saving money even before the virus emerged.

Shopping in China’s post-coronavirus world is not the pleasure it once was. Plastic barriers around shops, health monitoring at checkpoints, and the requirement that citizens show an app displaying their COVID-19 status all curb a major reemergence in shopping crowds. Most shops will not allow customers inside without scanning a QR code that reveals what locations they have visited previously.

While margins on production are high, China needs its shopping public to increase consumption. While Chinese people might be more likely to save money, it will be interesting to see whether Americans and Europeans similarly reemerge cautiously. Ensuring health and safety will surely take more priority, but China’s restart could be a reason for cautious optimism.