On April 19, the unthinkable happened: Oil prices fell below $0 and continued their decline. For the first time in history, purchasers of oil futures would actually pay to get rid of a barrel of oil. West Texas Intermediate (WTI), the benchmark US oil price, fell to negative $37.63. While most oil industry experts looked at the historic event in shock, BB Energy, a London-based oil trading house, spotted an opportunity and was paid to receive 250,000 barrels of oil.

How oil prices could go negative

Traders had earlier purchased “May futures,” which means purchasing oil for the current price to receive delivery of the oil in May. They did so with the intent to trade, instead of actually receiving the oil. As the futures’ expiry date approached, time was running out before traders would actually have to receive the oil that they had no means to store.

These trades are very common. Commodity markets often see people trading resources without the intent to receive the goods, instead selling the futures at a later date when prices have increased. For most important minerals and hydrocarbons, traders commonly exchange massive quantities of the resource merely to earn money from the exchange itself.

This speculation drives up prices. People trade without creating any value, but instead withdraw value from the actual crude in between production and delivery. When oil futures came due in April, these traders suddenly had thousands of barrels of oil due for delivery, with nowhere to store them, prompting the traders to consider paying others to take the oil.

How BB Energy exploited the moment

One company had plenty of space to store oil. BB Energy had probably expected to buy oil at unprecedented low prices. Instead, traders actually paid them to take the oil off their hands. In a moment when most traders could do nothing but stare at their screens in disbelief, BB Energy bought approximately 10% of all barrels of WTI crude futures.

It is unclear if BB Energy sold the oil after it rebounded in the following days. Even without selling the oil the purchases they will have profited, just by receiving it. The collapse of WTI in April came as US oil storage was starting to run out. For the upcoming month there is slightly more storage, but a potential threat could cause another drop into negative prices.

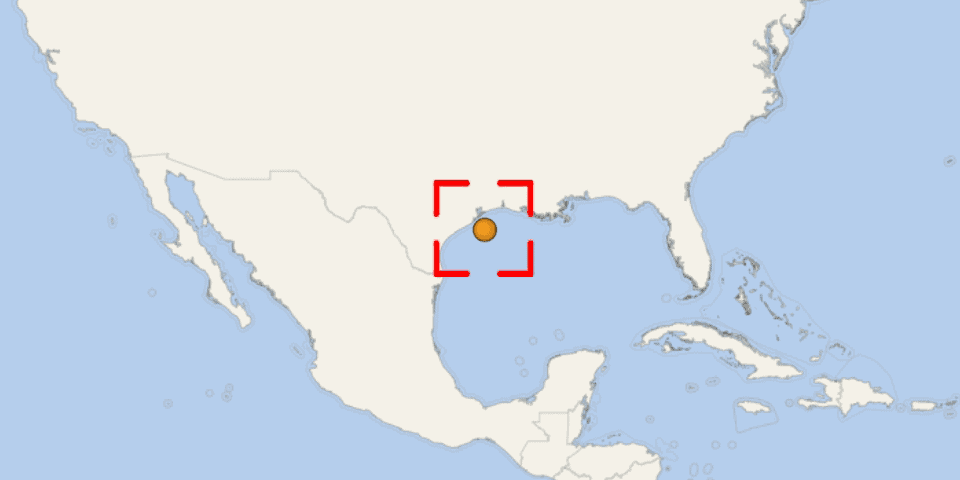

On May 18, the June futures of WTI will once again expire. At the same time, a Saudi fleet of tankers carrying millions of barrels of oil is off the coast of the US, getting ready to unload. If the Saudis flood the US market with cheap crude as futures again near expiry, traders can expect another dip into the negative. This time, others might attempt to copy BB Energy’s winning strategy.